Estimated payroll tax calculator

Form 500-ES contains an estimated tax worksheet and a voucher for mailing quarterly. 2022 than you did in 2021 or end up.

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Payroll taxes are always deducted directly from each paycheck so you rarely have to pay additional payroll tax on your income tax return.

. If you use this method but end up earning more money in. Estimated tax is the method used to pay Social Security and Medicare taxes and income tax because you do not have an employer withholding these taxes for you. Use our Free Self-Employment Tax Calculator to predict how much tax youll have to pay based on updated 2018 IRS tax tables and codes.

Then they are provided with a detailed analysis that gives estimated payroll taxes and net income. See Publication 505 Tax Withholding and Estimated Tax. For specific advice and guidance please call us at 1.

You have nonresident alien status. Press spacebar to hide graph - Definitions. These services are available for all tax professionals and their customers.

Offer period March 1 25 2018 at participating offices only. Based on your projected tax withholding for the year we can also estimate your tax refund or amount you may owe the IRS. Your refund has been determined by this Tax Return Estimator based on the tax data you entered.

Please note this calculator is for the 2022 tax year which is due in April 17 2023. IR-2018-36 February 28 2018. Form 1040-ES Estimated Tax for Individuals PDF is used to figure these taxes.

Employer Paid Payroll Tax Calculator. May not be combined with other offers. If your federal income tax withholding plus any timely estimated taxes you paid amounts to at least 90 percent of the total tax that you will owe for this tax.

Our nanny tax calculator will help you to calculate nanny pay and determine your tax responsibility as a household employer whether paying a nanny a senior. Understand your nanny tax and payroll obligations with our nanny tax calculator. Although this is sometimes conflated as a personal income tax rate the city only levies this tax on businesses.

Use the following calculator to help determine your estimated tax liability along with your average and marginal tax rates. The payroll tax consists of two halves - one half is paid by the employee and one half is paid by. Use Notice 1392 Supplemental Form W-4 Instructions for Nonresident Aliens.

Meaning your pay before taxes and other payroll deductions are taken out. WPRO-10 2021 Estimated Tax Refund. How Marginal Tax Brackets Work.

W-2 income. WASHINGTON The Internal Revenue Service today released an updated Withholding Calculator on IRSgov and a new version of Form W-4 to help taxpayers check their 2018 tax withholding following passage of the Tax Cuts and Jobs Act in December. E-File With Income Tax Software.

Californias base sales tax is 725 highest in the. To avoid the IRS underpayment penalty you can choose between the following approaches. Form 1040-ES contains a worksheet that is similar to Form 1040 or 1040-SR.

Key Takeaways If you expect to owe more than 1000 in federal taxes for the tax year you may need to make estimated quarterly tax payments using Form 1040-ES or else face a penalty for underpayment. Lets say you have a job that pays 20 per hour but after taxes and retirement contributions your take-home pay is only 14 per hour. If you expect to earn about the same amount as last year you can take the amount of tax you paid on your 2021 return and divide it by four to figure out your 2022 quarterly estimated tax amount.

That works out to 4273 in quarterly estimated taxes or 1424 if you want to pay monthly. 1040 Tax Estimation Calculator for 2022 Taxes. With our payroll tax calculator you can quickly calculate payroll deductions and withholdings and thats just the start.

WPRO-11 Enter the date you will submit this W-4 Form to your employer or payroll department. But if you are self-employed or make money on your investments or rental property you may need to make estimated tax payments every quarter rather than wait until you file. To qualify tax return must be paid for and filed during this period.

This is a sample calculation based on tax rates for common pay ranges and allowances. The city of San Francisco levies a gross receipts tax on the payroll expenses of large businesses. About Publication 15 Circular E Employers Tax Guide About Publication 17 Your Federal Income Tax For Individuals About Publication 225 Farmers Tax Guide.

You can use our free Georgia income tax calculator to get a good estimate of what your tax liability will be come April. Filing Quarterly Estimated Taxes. Your tax situation is complex.

Federal Income Tax Rates Use the table below to assist you in estimating your federal tax. Use this federal income tax calculator to estimate your federal tax bill and look further at the changes in 2021 to the federal. WPRO-12 In addition to your current IRS.

Therefore you will not be responsible for paying it. Your individual results may vary and your results should not be viewed as a substitute for formal tax advice. Paycheck Managers Paycheck Calculator is a free service available for anyone and no account is required for use.

Payroll taxes are always deducted directly from each paycheck so you rarely have to pay additional payroll tax on your income tax return. As a result many taxpayers are unaware of the true amount they pay in payroll taxes. California collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

If you are an employee your employer withholds income taxes from each paycheck based on a completed W-4 Form. Usually thats enough to take care of your income tax obligations. Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview.

The IRS urges taxpayers to use these tools to make sure they have the right. The payroll tax consists of two halves - one half is paid by the employee and one half is paid by. Unlike your 1099 income be sure to input your gross wages.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Texas local counties cities and special taxation districts. Estimate your tax withholding with the new Form W-4P. You can also use the same tool to calculate.

This box is optional but if you had W-2 earnings you can put them in here. Like the Federal Income Tax Californias income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. Enter your filing status income deductions and credits and we will estimate your total taxes.

Your taxes are estimated at 11139. As a result many taxpayers are unaware of the true amount they pay in payroll taxes. Taxes are unavoidable and without planning the annual tax liability can be very uncertain.

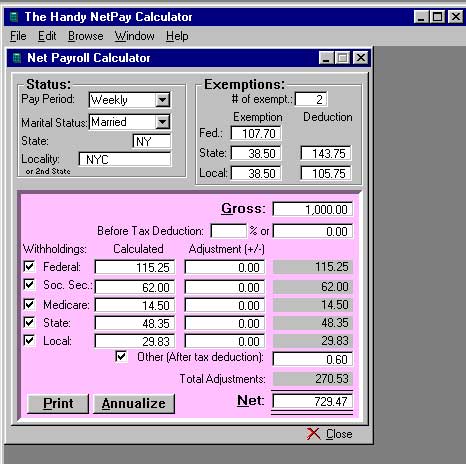

Adding this estimated income tax to your self-employment tax of 9890 gives us the amount you should make in estimated payments over the course of the year. Your taxes are estimated at 11139. Users input their business payroll data including salary information state pay cycle marital status allowances and deductions.

This includes alternative minimum tax long-term capital gains or qualified dividends. 2021 Tax Calculator to Estimate Your 2022 Tax Refund. Californias maximum marginal income tax rate is the 1st highest in the United States ranking directly.

Virginia Tax designed this page to provide documentation available services and updated tax resources used by tax preparers and payroll providers who assist customers with their tax needs. Social Security. There are many benefits of using a payroll calculator including the ability to estimate your paycheck in advance.

Payroll Tax What It Is How To Calculate It Bench Accounting

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

How To Calculate Payroll Taxes Methods Examples More

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Federal Income Tax Fit Percent Method How To Calculate Fit Using Percent Method Youtube

Paycheck Calculator Take Home Pay Calculator

How To Calculate Federal Withholding Tax Youtube

Federal Income Tax Fit Payroll Tax Calculation Youtube

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

W 2 1099 Filer Software Net Pr Calculator

Solved W2 Box 1 Not Calculating Correctly

Payroll Calculator With Pay Stubs For Excel

Paycheck Calculator Take Home Pay Calculator

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Enerpize The Ultimate Cheat Sheet On Payroll

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Payroll Tax Calculator For Employers Gusto